new orleans sales tax percentage

How much is tax on food in New Orleans. The minimum combined 2022 sales tax rate for Orleans Parish Louisiana is 945.

Properties with delinquent 2019.

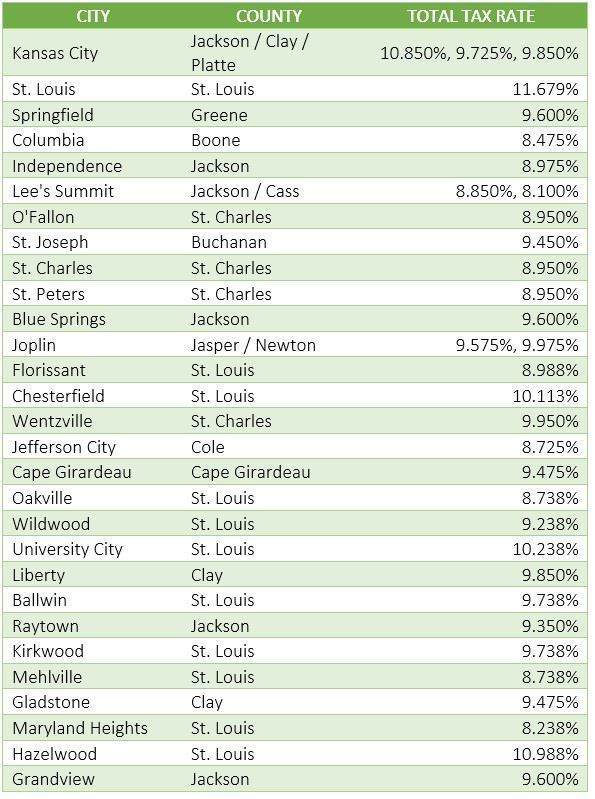

. This rate includes any state county city and local sales taxes. Orleans Parish in Louisiana has a tax rate of 10 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Orleans Parish totaling 6. What is the sales tax in Louisiana 2021.

Sales Tax 504 658-1666 504 658-1648 504. The 2018 United States Supreme Court decision in South Dakota v. The City of New Orleans.

Get information on personal and corporate taxation rules and principles in New Orleans. Has impacted many state nexus laws and sales tax collection. The Louisiana state sales tax rate is currently 445.

A flat tax of 35 applies to the taxable income of a corporation that has taxable. The Orleans Parish Louisiana sales tax is 1000 consisting of 500 Louisiana state sales tax and 500 Orleans Parish local sales taxesThe local sales tax consists of a 500 county. Average Sales Tax With Local.

Orleans Parish collects on average 061 of a propertys assessed. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018. The minimum combined 2022 sales tax rate for Orleans California is.

Louisiana Sales Tax on Car Purchases. The Bureau of Revenue - Sales Tax provides a number of services for businesses and citizens in New Orleans. Once a tax-payer has filed six monthly returns he may apply for and receive a quarterly filing status providing.

The latest sales tax rate for New Orleans LA. Yes sales tax is required on all food items. Parish E-File can pay City of New Orleans and State of Louisiana sales taxes together SalesTaxOnline.

Louisiana Sales Tax Orleans Parish Tax Rate Total Tax Rate. All returns for new accounts for state sales tax must be filed on a monthly basis. There are also local taxes of up to 6.

Louisiana has recent rate changes Tue Oct 01 2019. Revenue Information Bulletin 18-017. Louisiana collects a 4 state sales tax rate on the purchase of all vehicles.

With local taxes the total sales tax rate is between 4450 and 11450. The combined Louisiana and Orleans Parish tax rate is 945. The California sales tax rate is currently.

You can find more tax. 2021 Present French Quarter EDD Imposed. 519 rows 2022 List of Louisiana Local Sales Tax Rates.

The median property tax in Orleans Parish Louisiana is 1131 per year for a home worth the median value of 184100. There is no applicable city tax or special tax. Select the Louisiana city from the list of popular.

The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax and 5 Orleans Parish sales tax. 2020 rates included for use while preparing your income tax. Lowest sales tax 445 Highest sales tax 1295 Louisiana Sales Tax.

Many dealerships allow you. The City of New Orleans tax rate is 5. This is the total of state county and city sales tax rates.

The estimated 2022 sales tax rate for 70118 is. This is the total of state and parish sales tax rates.

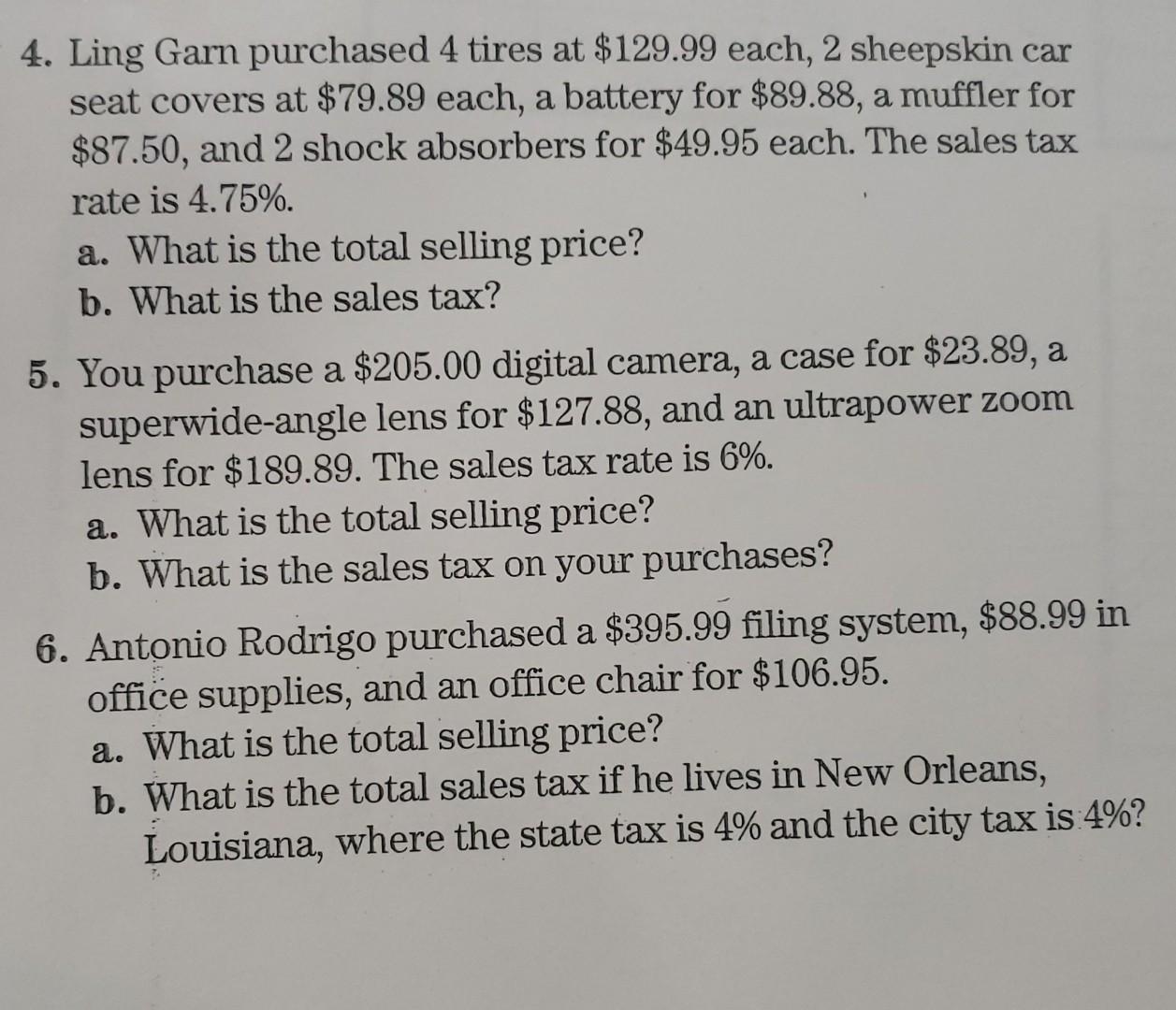

Solved 4 Ling Garn Purchased 4 Tires At 129 99 Each 2 Chegg Com

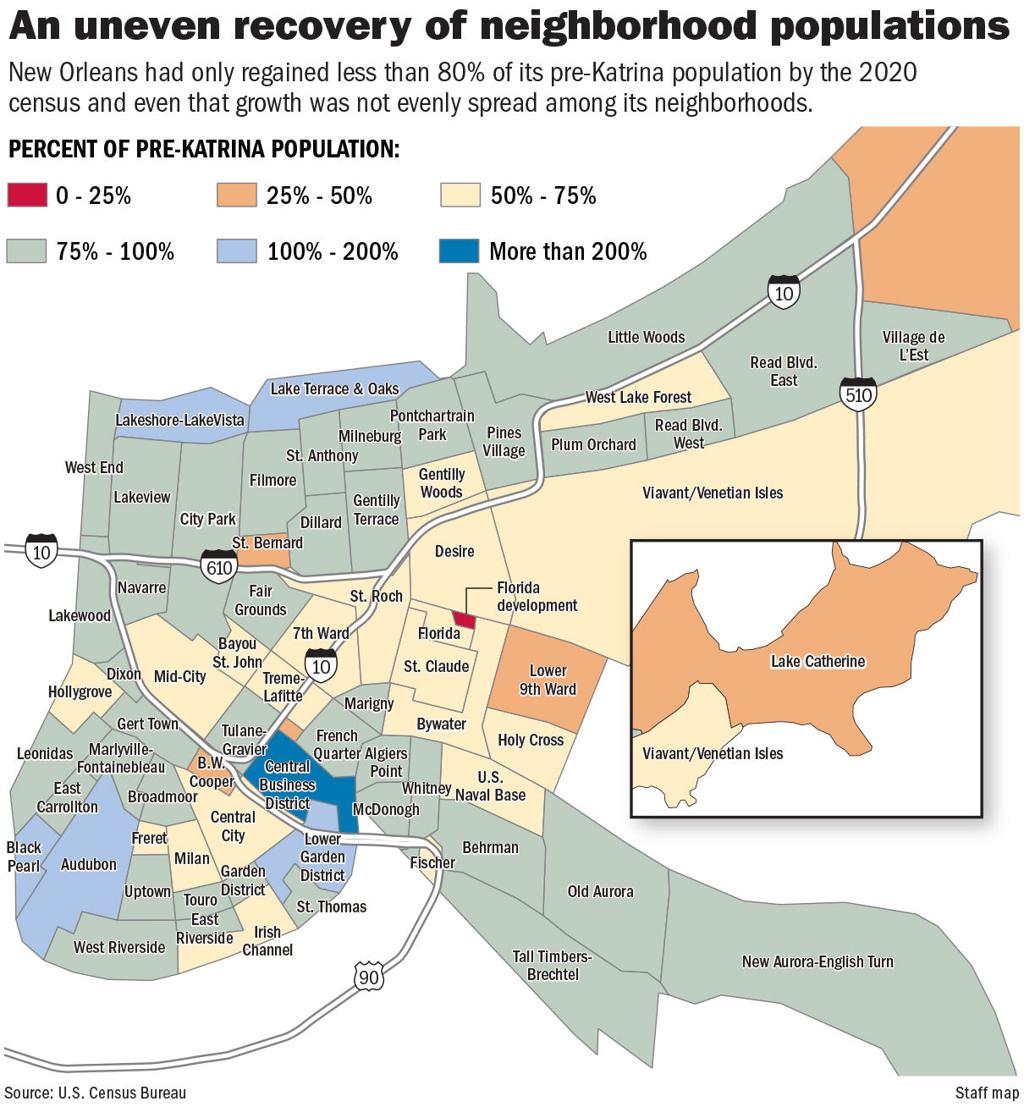

15 Years On New Orleans Uneven Recovery From Katrina Is Complete Population Slide Resumes Local Politics Nola Com

Louisiana Income Tax Calculator Smartasset

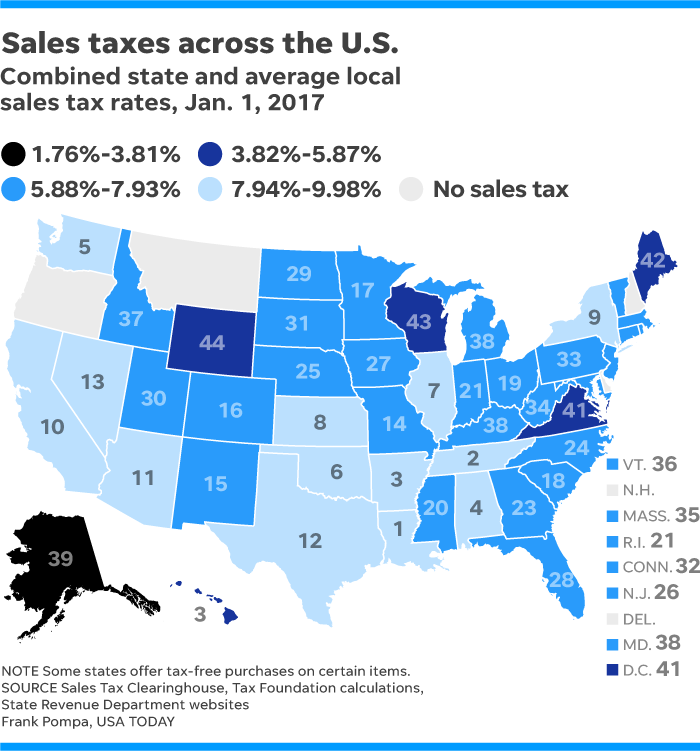

Louisiana Will Still Have Highest Sales Taxes In Nation

Louisiana Sales Tax Rates By County

State And Local Sales Taxes In 2012 Tax Foundation

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Louisiana Sales Tax Guide And Calculator 2022 Taxjar

.png)

Sales And Use Tax Department Lafourche Parish School District

Louisiana Voters Approve Income Tax Swap New Orleans Reelects Cantrell

Policywatch Revisiting Assessment Issues In New Orleans

States With The Highest And Lowest Sales Taxes

July 2022 Sales Tax Rate Changes

Understanding Your Entergy Bill

New Orleans City Council Approves New Short Term Rental Tax

Louisiana S New Internet Sales Tax Collection System Might Be Delayed Until 2020 Here S Why Legislature Theadvocate Com

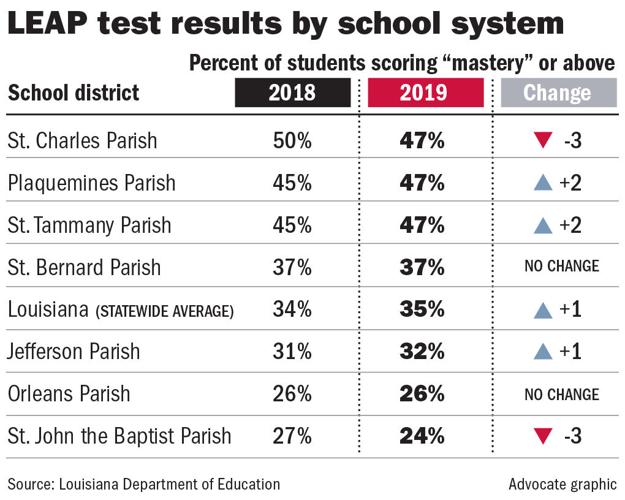

A Dip In Leap New Orleans Area Schools See Lower Or Stagnant Scores As Tougher Standards Continue Education Nola Com